Economic Value Added (EVA) Brief: PT Saranacentral Bajatama Tbk (BAJA.JK)

- Rio Adrianus

- 21 Mei 2019

- 4 menit membaca

Diperbarui: 23 Mei 2019

If you read Bisnis Indonesia, you would get a particular lengthy stock analysis from time to time. There is one stock that I remember vividly back when I used to read BI regularly in 2017. Let's take a quick look at BAJA. From the story point of view, I think the analyst was pretty convincing to make BAJA as a value stock. BAJA, after all, had just made one pretty significant upswing after fell to the ground until 2016. At its peak in 2014, BAJA share price was IDR 1,700/share. The analyst had been accumulating it since its price was around IDR 330/share. Back then, I did not know EVA, and I was tempted to buy this stock. By some luck, I did not buy it. So the point of this research is to answer: Had I known EVA back then, would it make any difference?

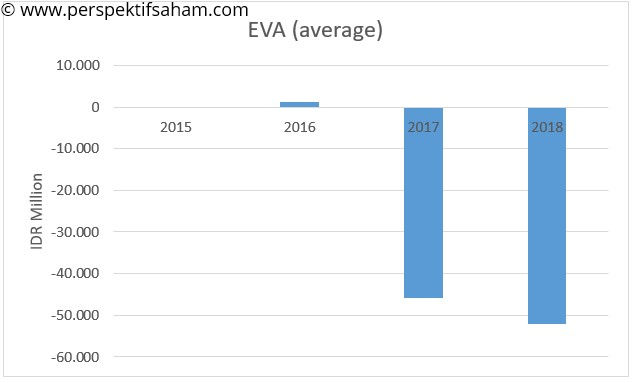

My data stopped at 2014, hence, EVA could only be reliably measured starting in 2015. But I have a clue that EVA back in 2014 was negatively horrible. This was why its share price plummeted in 2015. Investors finally realized that IDR 1,700/share was a mistake. In 2015, there was a good improvement in EVA which continued until 2016. So far, I only back up a positive analysis for BAJA.

We now know that EVA was horrible in 2017 and continued to this day. But the analysis was made sometime in 2017. The most recent EVA data back then was most likely Q4 2016 (and maybe Q2 2017, which would very likely tell us that BAJA was in trouble). So, I would limit myself to 2016. The question is: What would I know from EVA, had I only known EVA relevant data just up until 2016?

The first thing to note is EVA improvement in 2016 was only marginal. It was thanks to better productivity which was caused by improving NOPAT margin.

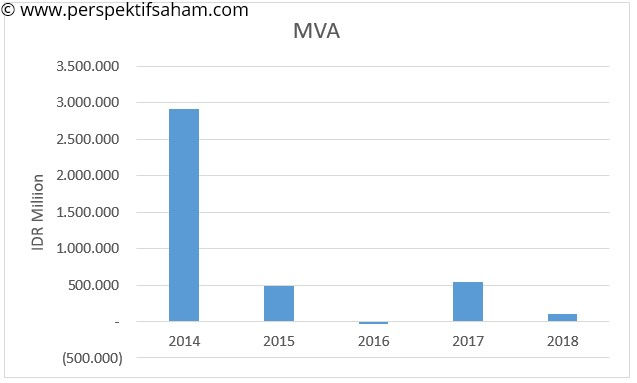

The information that really helps is in MVA (Market Value Added). It is the amount of EVA stream generated in the future that is being expected by the market. Back in 2014, the expectation was hype. When investors realize EVA plummeted in 2014, they corrected themselves in 2015, driving down MVA. Now, here is the interesting part. In 2016, when the share price hit rock bottom, MVA was negative, although now we know that EVA had bounced back since 2015, and was actually positive in 2016. But with MVA being negative in 2016, we know that investors were expecting negative EVA down the road. So, back in 2016, it was actually a good bet if we have a reasonable basis that there would be some improvement in EVA in 2016, which was true.

EVA did improve to a positive level in 2016. This is why investors corrected themselves again in 2017. But, here is another perspective from EVA: we know that the improvement in EVA was only marginal, so we should not expect much. In fact, if we run some numbers, by assuming EVA to stay flat, we would know that the fair price of BAJA would only be IDR 100/share. We could expect some more of course, because investors tend to overreact, driving the price much further than what is fair. But I think anyone with a rational mind would know that driving it up to IDR 400/share is already taking it too far. EVA investors should be out by then unless they have solid reasons why EVA would continue to grow much faster than what has been the case in 2016. It turns out there never was such a case. EVA plummeted in 2017 and remains so to this day.

As a side note, this is how IDR 100/share was calculated. Suppose EVA to remaining flat at 2016 level. That is IDR 1,3 Billion forever. At WACC 12%, NPV would be around IDR 10,6 Billion (IDR 1,3 Billion/12%). Enterprise Value is simply invested capital plus NPV. Invested Capital in 2016 was IDR 408 Billion. So, Enterprise Value was IDR 419 Billion (408 + 10,6). That is the market value of debt and equity. Important to note is that EVA and MVA calculation did not include excess cash (I just exclude all of the cash usually). With debt value of IDR 281 Billion in 2016 and excess cash of IDR 40 Billion, the equity value would be IDR 177 Billion (419 – 281 + 40). Divide that number with shares outstanding of 1,800 million, BAJA share price assuming no EVA growth back in 2016 was IDR 100/share.

A courageous, but cautious EVA investor would dare to buy BAJA stock shortly after AR report came sometime in the first half of 2016. He would then got out before BAJA reached IDR 400/share, and when he read the analysis from Bisnis Indonesia somewhere in mid-2017, he would just nod his head knowing he had realized his profit and watched closely if there are signs that 2017 would be a better day. He would very much likely to conclude by Q2 financial statement that it was not the case, far from it.

Komentar