EVA Brief: LPPF (Matahari Dept Store) Q2 2020

- Rio Adrianus

- 30 Agu 2020

- 4 menit membaca

Accountants no longer accept operating lease. LPPF is a hard wake up call for me to take operating lease adjustment seriously. The fact is, LPPF has a significant lease under operating lease. If you don't adjust it, this year's result will bring you tons of surprises.

I find it ridiculous when lots of people think that when accountants change their rules, it will affect Mr. Market. They assume that Mr. Market can't see through accounting games. Here's a better idea: always assume that Mr. Market sees right through anything (including a change in accounting rules) that don't affect cashflows. Abolishing operating lease rule does not affect ANYTHING in the real world. That same business still makes the same rent.

EVA always treats leased asset as if the asset is owned, in other words, EVA has never agreed to operating lease where the asset is not shown in the balance sheet---which is exactly what the accountants finally agree now.

I have to admit, I did not adjust the operating lease in prior LPPF analysis. It is a big blunder that could to disastrous investment decision. When I did, here is what I have found:

First thing first, it did not change the big picture outlook that LPPF economic profit has been in declining for some years now. Q2 2020 fell hard.

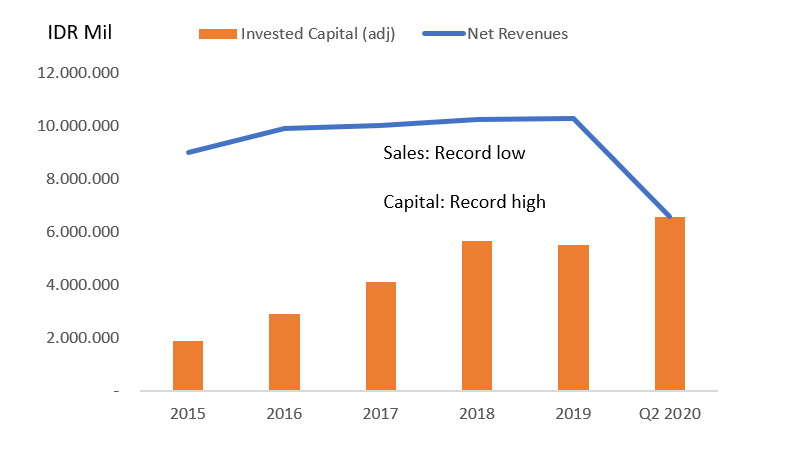

However, the accounting adjustment brings to light how capital intensive LPPF really is

On average, operating lease hides 55% of its total invested capital.

Since a lease is a form of debt, that also means that LPPF is heavily debt-financed.

The most important thing is LPPF has become economically unprofitable for the first time, unable to cover its cost of capital (which I believe to be somewhere around 11%).

It looks like the accountants adjust LPPF operating lease by taking its rental expense into perpetuity. It has a rental expense multiplier of 17. It is confusing because the accountants seem to assume an asset life of 5 years in its depreciation calculation. I decided to use the same adjustment for LPPS past data with an additional assumption of a 4% interest rates on leased assets.

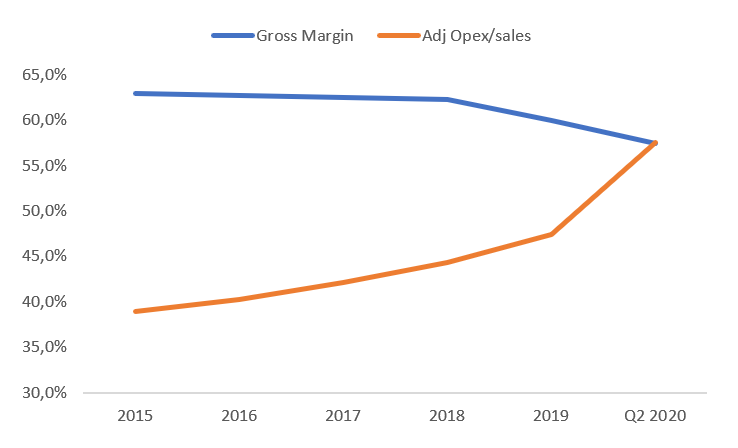

This complex exercise sheds an important light: The main problem of LPPF, that is, unable to grow its sales more than the growth rate of its employee salaries, is getting worse now.

Compared to last year, revenue is down by 62% while employee salaries is cut by 21%. To cut salaries by more than 30% could only mean massive layoffs. The management so far has managed not to go to that length. And hence, shareholders must eat severe reduction in operating margin. Last year, NOPAT margin was 10%. In Q2 2020 (LTM), it was -0,2%.

To add, contrary to what media tells us, I do not find the change in accounting rules has a positive effect to operating margin. After adjustments, I find that the rent expense recognized under current rule is unchanged (relative to sales) compared to last year. Adjusted rent expense, which is the non-interest portion and depreciation, was 19,8% to sales in 2019. In Q2 2020, it was 21,4%. Rent is negotiated just well enough, but not to the point where it is positive for economic profit.

Aside from problem in operating margin, what else is different now? Sales is down a lot. Maybe to a level last seen pre-2015. The thing is, LPPF is now much more capital intensive than before. In fact, the management keeps expanding in this year. LPPF has 3 new big stores this year. Maybe it is the reason why some inside shareholders left.

From the inventory notes, we could see that people do not dare to take their children to shop for their clothing, and everything else is down. Until a vaccine is found, this won't change.

When data changes, I change my mind too

I write EVA Brief to give readers not just a solid, reliable big picture based on economic principle. It also serves as an open book to my perception and its changes which you could trace from past archives. Here, I will summarize my perception of LPPF as an investment candidate.

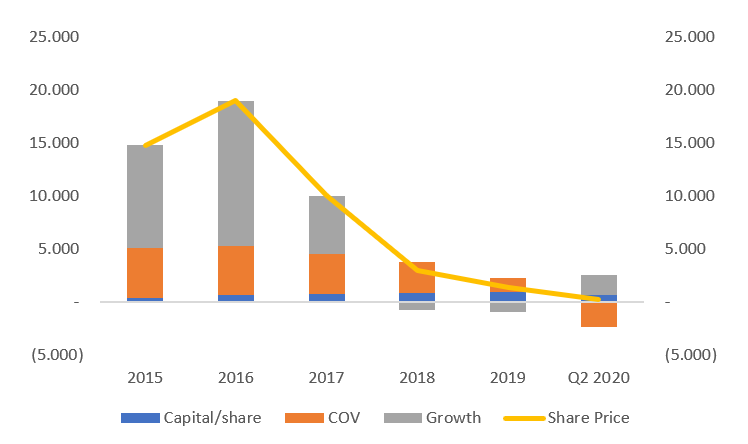

In 2018, LPPF share price was 3.000/share. It looked very attractive. Its EVA has been declining for two consecutive years, but the implied market expectation was too pessimistic as you can see from the negative growth expectation (see chart below). Before that, I could not see a compelling reason to invest as the implied economic profit growth expectation was too much.

As I have repeatedly written, understanding the company's true performance is only half the job. Investors need to understand what the market is saying about the company's prospects. It could only be done if you have a good understanding of how performance is intrinsically tied to its valuation. Paying LPPF for 20.000/share is a sign of the lack of that understanding.

As it turned out, the market was right in 2018 when it expected EVA contraction to go on. EVA continued to contract, and sharply in 2019. However, LPPF was still able to deliver economic profit, and there were signs that people are still attracted to discounts. The major problem for LPPF back then was it could not grow its revenue faster than the growth rate of its employee paychecks. Of course, giving a larger discount would back-fire. But the situation back then was not bleak enough to give LPPF value below its book value.

Then comes coronavirus. Margin is squashed unless the management starts to fire a lot of people, its revenue is at a record low, and its investment level is on a record high. EVA is negative for the first time. I do not see this will change anytime soon. It could get worse.

The situation has changed dramatically. I reason that LPPF should trade below its capital (book value). So far, it has not.

I have a depressing target level where I think LPPF could be heading. To my surprise, 720/share is not a level where LPPF trades below its capital. So, I opt for the lower one. If it reaches that level, LPPF definitely would become a strong investment candidate. But there is still a lot of time. Data could change, and so will I.

Komentar