EVA Brief: PT Totalindo Eka Persada Tbk (TOPS.JK) June 2019

- Rio Adrianus

- 17 Jun 2019

- 2 menit membaca

From its IPO around IDR 120/share to its peak so far at IDR 952/share in just one year seems fantastic and may give us the illusion that this is a gold nest company. I was there when the management held an event to build up interest prior to IPO, and I certainly was interested.

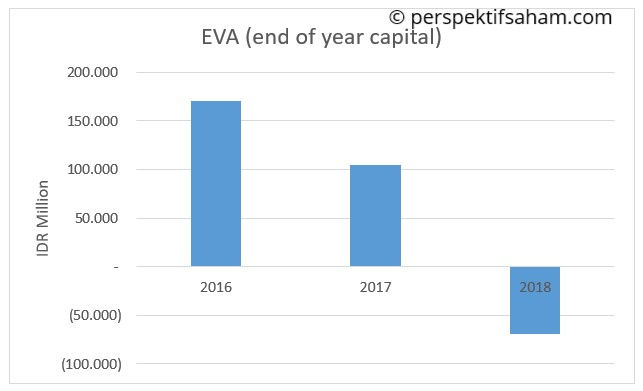

What is clear now is whatever optimism was given before, it is ungrounded. EVA is in a spectacular decline last year, and there is a good indication by measuring EVA with end-of-year capital that EVA has been in a declining trend. The message in last year performance was clear: TOPS is not profitable enough to provide investors minimum returns for their capital.

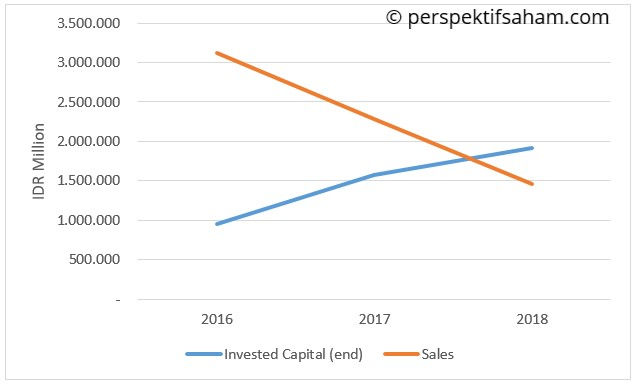

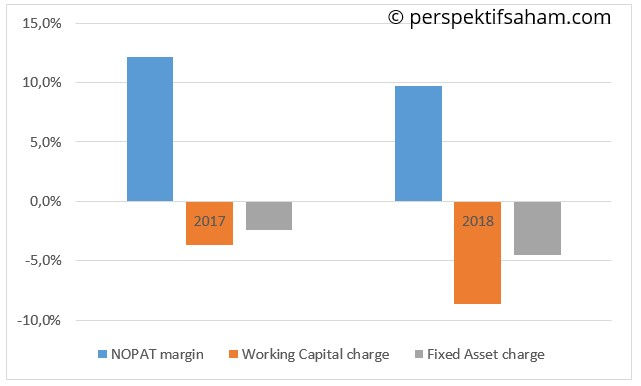

I think the chart below is quite telling why this is so. Sales have been declining while TOPS has been stepping-up its capital investments. This situation is made worse by declining operating margin last year, although its impact is not to be overstated.

If you think TOPS is making a strategic investment that depresses EVA for a short while in order to get much higher EVA later on, I beg to differ. A sharp rise in working capital in tandem with declining sales is most likely a strong indication of problems rather than an indication of investing for growth. The further financial analysis gives me a picture that the problem is more than just the story of a halt in new contracts tender. What they do not tell you is project owners and suppliers have become more unwilling to be paid later by TOPS. This is why the working capital charge rose up significantly last year. In other words, a key component to a much-needed EVA margin improvement is beyond the handle of TOPS management.

How about investors' valuation relative to the company's actual performance? All I have found is investors have been highly optimistic even since IPO. About 50% of the total market value near IPO is due to EVA growth expectation. At its peak last year, that expectation number has become 97%. It is dangerously high. Almost all of its market value is based on the expectation that the future is going to be better. Current performance is not just going to cut it. EVA needs to grow 57% a year, adjusted to sales, for the next 5 years from its last performance (which is a negative IDR 50 Billion).

However you look at it, the expectation is unrealistic and I believe there is no need to look further on stories of how it might get better. EVA might get better. But it does not matter at present because the expectation is still too high even now. To be frank, from a fundamental perspective, I do not see how this stock could be attractive without consciously making some serious, highly unrealistic, assumptions. The fact that this stock has reached IDR 952/share is instructive to rational investors to be cautious and not trusting in general. I firmly believe, backed by EVA findings, that this stock has been inflated to a bubble state. The bubble seems has burst.

Komentar