EVA on IPO: UCID (Uni-Charm Indonesia)

- Rio Adrianus

- 3 Jul 2020

- 3 menit membaca

Diperbarui: 4 Jul 2020

Uni-Charm boasts its almost 50% of market share of baby diapers (Mamypoko) in Indonesia. Its parent company is based on Japan, so they see lots of untapped potential here. The company estimates that Japanese babies use 5x diapers than Indonesian babies.

But for whatever optimism they may have, it does not change the fact that it is operating in highly competitive arena where earning economic profit is proving to be difficult.

Some analysis which is based on EPS multiple would say it is expensive because it is currently trading at PE 15x (read here). On the other hand, I would argue that UCID is undervalued at 1.465/share IF its recent performance trend continues.

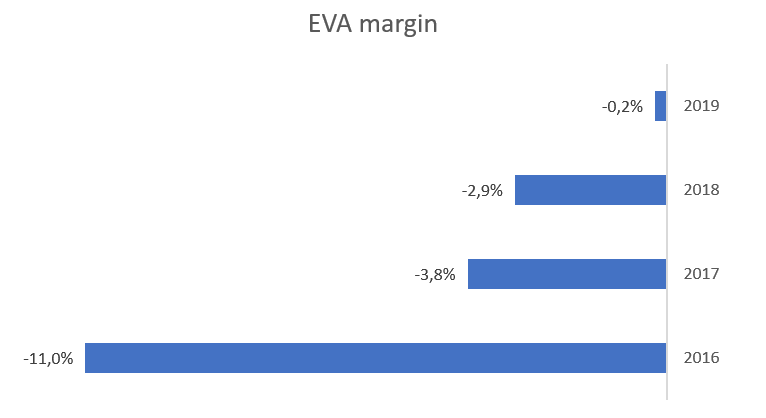

Let’s be more specific. UCID EVA performance is as follows:

A dramatic rise, especially in 2019. It is in a nearly break-even condition, or earning the required minimum, which is not bad at all.

To justify its current share price, a discounted EVA model shows that investors are only expecting EVA momentum of 0,6%. In terms of EVA trend, the expectation looks like this:

EVA momentum of 0,6% is not a tall order. If UCID could meet that expectation, it would be the most credible fundamental argument why a share price would rise, and even more so if it could exceed that. It is not just in theory. I have shared this finding in several articles here.

The problem is, I don’t think it is possible. I very much doubt UCID EVA could rise even further than 2019. It is very important to recognize the fact that EVA margin has never been positive. Its ROIC is below is cost of capital. In its IPO prospectus, the management admits it is operating in a highly competitive arena.

We need to understand the source of its 2019 improvement as that may point to its weakness and its limit. In UCID case, the improvement came largely because it could grow its sales while maintaining its operating expenses fixed. That is the key operational excellence of UCID: fixed operating expenses.

UCID products are the property of its parent company in Japan, so it has to pay royalty, which is pretty much fixed. The products are then stored in warehouses and distributed by third parties. These 2 components are critical to be maintained, and if possible, reduced. It is a good thing that the company seems to put emphasis on its distribution management in its prospectus.

However, the fact remains that although warehouse expense has gone down a little, its freight expense has gone up, which leaves operating expense relatively unchanged.

Another critical factor to consider, 30-40% of baby diaper is made from oil-based product meaning that this stable gross margin picture is here to stay if oil price remains weak. This oil is paid in dollar, so it has a currency effect into the mix. So far, IDR weakening effect has been offset by the decline in oil price leaving gross margin stable. We are still living in an era of low oil price, that is likely to remain for a long time, and IDR is back to where it was at the start of the year. So, we are likely seeing a continuation of relatively unchanging gross margin this year.

There is one more limiting factor which is its fixed assets. Its machines is now operating 80% of its full capacity. Absent of a rise in ASP, that leaves 15% of sales growth to almost IDR 10 T without purchasing new machineries. At that point, if it could be achieved, UCID would be running at its maximum potential...and that would bring its EVA margin around 1,3%. So, even if it is running at its full potential, it is still not a great business anyway. This is consistent with its highly competitive arena. On the other hand, my hands are off the table if UCID makes a huge purchase for new machines. That move would almost a guarantee to destroy EVA (the investment does not pay off) because it is operating in a highly competitive segment.

My View, @1.465/share

The bottom line: unless you have a good reason to believe UCID EVA would continue to grow, preferably at 0,6% EVA momentum in this year, it is not worth the risk. One of the ways that 0,6% EVA momentum could be achieved is if UCID could keep its operating expense unchanged while still be able to drive 5% sales growth. Like I said at the beginning, it is not a tall expectation and I disagree to a view that sees this as too expensive. The thing is, there is not much room for improvement, and I don’t prefer to buy fairly.

Komentar