EVA Brief: CLEO (Sariguna Primatirta) Q2 2020

- Rio Adrianus

- 30 Agu 2020

- 4 menit membaca

A note from prior analysis: Aside from recent stagnation on revenue growth which leads to a decrease in EVA, there is not much change from prior analysis. Moreover, in November last year I wrote that CLEO was severely overvalued and expected a notable decline to a more rational level, given its history, to 260/share where the expected EVA momentum is 4%. Spot on. I'm now saying that investors have already pushed it too far, again.

But let’s have a fresh look on CLEO, it's been a while.

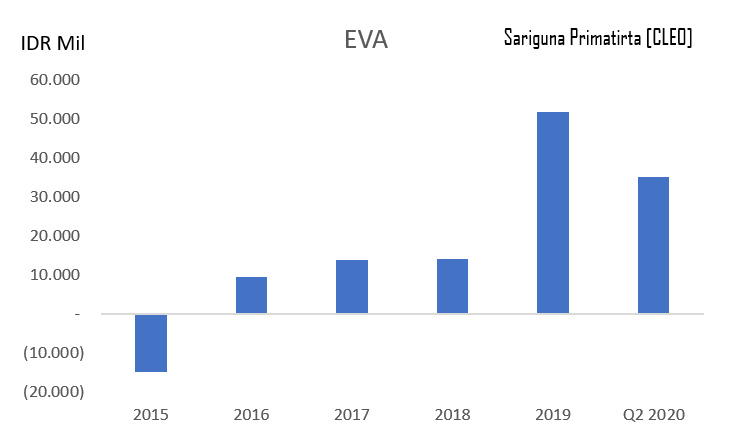

CLEO’s economic performance is not bad after 2015. 2019 was especially good. In this year, CLEO is one of the few who are less impacted by current general condition.

It is not far from what could be called as a break-even economically. I used WACC of 11% in my EVA above. If I changed it to 13%, CLEO is even closer to generate zero economic profit.

A critical question right now is: Could its EVA momentum, at least next year, reach 5% (EVA momentum is the change in EVA divided by prior year’s sales).

Or, put it in another way, how plausible is below projection?

I very much doubt that is the fate in store for CLEO.

Why am I bringing up that chart?

It’s because that is how much CLEO economic profit has to grow in order to justify its share price...back when it was at its lowest point this at 270/share. Of course, now it is much higher.

A share price is a business value and a business value is the sum of its cashflows it could make.

A rational mind would only be attracted to CLEO if he/she believes CLEO could grow its EVA (cashflows) faster than what Mr. Market says. It takes discipline and hard-won knowledge to invest based on value, which is really what investing all about.

That projection is based on a model, and of course, every model has some assumptions.

Another way to see what the market is saying with less assumption is to look at how much NPV (net present value) a business could make. I have written a detailed explanation about this in Stockbit. Simply put, a wealth creator has positive NPV. In turn, NPV is the sum of present value of EVA. That EVA projection above is the way I slice this NPV (which the market expects) into specific periods.

In the following chart, I break down share price into two main components: its invested capital and expected NPV. Expected NPV could be divided further into: NPV if current EVA remains the same (COV), and additional NPV expected by investors (growth).

The larger the growth component is, the faster EVA is expected to grow. You can also think about it like this: In order to justify the share price (fairly valued), the business has to generate additional NPV as much as the grey area on top of the orange area (NPV from current operation).

As you can clearly see, CLEO share price has been mostly supported by expectation that its NPV could sky-rocket. In reality, EVA growth has never been spectacular.

Again, that Q2 2020 bar you see above is when its share price was at its lowest recently at 270/share. Now, it is 525/share, so the growth component is now twice as large.

To be honest, the extreme expectations already in place makes CLEO a hard pass for me. Investing in CLEO is like playing an already losing game. I am convinced, it will crash mercilessly, as all overtly overvalued stocks do in the end.

At this point personally I see little point in taking the analysis further. But let’s do that.

First, it is very important to understand why EVA in 2019 grew rapidly. EVA momentum in 2019 4,5%. At its recent bottom (270/share), the market implicitly expects EVA momentum of 5% from recent performance (Q2 2020).

Could CLEO manage to do that? If it could grow its EVA like last year, it is a good enough reason to at least say that Mr. Market has been pessimistic. It would still be a poor bet in my opinion, because the overall expected NPV is just too high.

I don’t think it could. CLEO management has been greedy. They invest rapidly.

That needs to be compensated by high sales growth. Unfortunately, that revenue growth has stopped this year.

Suddenly, fixed asset charge jumped. That is what happens when you become heavy too fast.

The result is a rapid decline in profitability (EVA margin).

Unless CLEO could repeat its sales growth story in 2017-2019, there is almost no way EVA could reach its 2019 level, let alone reaching EVA momentum of 5%.

The reason why CLEO EVA grew so well in 2019 has a lot to do with better gross margin than in 2018. The gross margin itself was not a record high. It was at the level of 2017.

As you can see, post-2016, gross margin has been higher. I believe that is largely because PET price has been collapsing (chart below is LLDPE futures, dominated in Yuan).

I don’t think it’s because of a change in product mix. Water in gallons has a higher gross margin than water in bottles. But look at the revenue chart above. Demand for bottled water is livelier.

And did you notice? Gross margin is even higher this year! No surprise, if you look at the futures chart above.

However, even with that record high in gross margin (and yes, it leads to a record high in operating margin), EVA is lower! That’s not enough to cover the economic charge from its huge capital. Only good sales growth (as in, 15%) will do, and that is just to maintain its EVA the same as last year.

You might think that because revenue is stable, CLEO is doing just as well. Moreover, if you look at its net income, you might think that it is getting better!

It is not. Its economic profit is shrinking.

A good deal of optimism is required to perceive CLEO as attractive. Gross margin remains at a record high and revenue growth is back just like how it was in 2018 and 2019, and you need more to have margin of safety.

Afterthoughts:

Personally, I don’t find CLEO to be an attractive investment if its share price is above 150/share. I don’t think CLEO could grow its EVA fast enough to reach NPV of IDR 5,4 Trillion, which is what the market is saying now at 525/share. If CLEO business could not grow its EVA from current condition, its NPV would be IDR 319 Billion. At its peak in 2019, assuming the same, CLEO NPV would be IDR 471 Billion.

Komentar